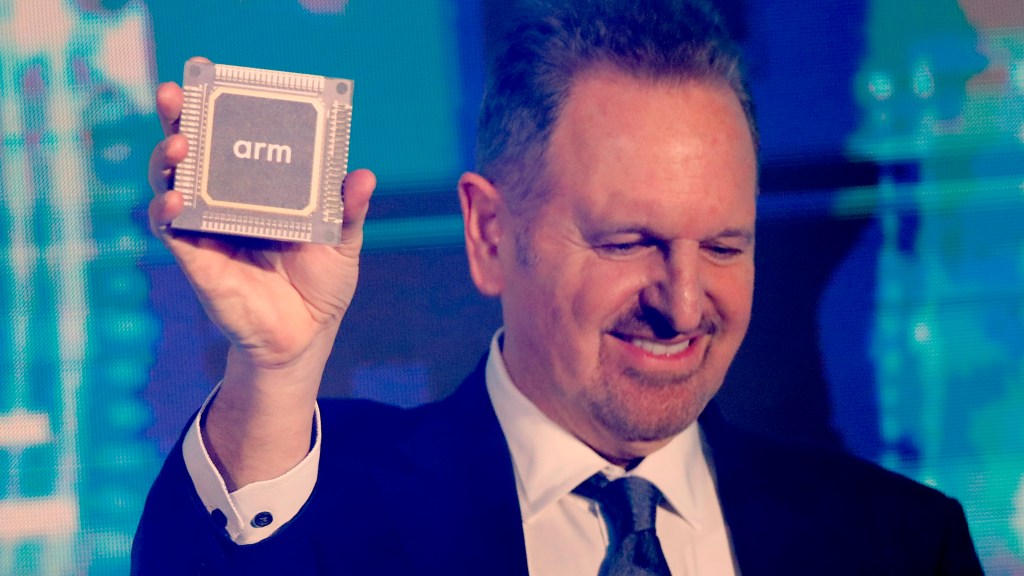

Arm Holdings Shares Decline Due to Disappointing Sales Forecast

Arm Holdings, the British chip manufacturer, surpassed Wall Street’s revenue expectations for the quarter but issued a less than optimistic sales forecast, raising concerns about the impact of tariffs on demand.

By mid-morning on Thursday in New York, Arm’s shares had plummeted nearly 6 percent, or $7.34, settling at $116.09 following its announcement of a first-quarter revenue outlook between $1 billion and $1.1 billion. This projection fell short of analyst forecasts.

The company cited a significant licensing deal that is unlikely to be finalized within the first fiscal quarter as the primary reason for the disappointing outlook.

Arm anticipates a “limited, direct impact on our royalty and licensing revenues” stemming from the effects of tariffs and broader market uncertainties. The company noted it has reduced visibility regarding the “indirect impact on demand”.

In its fourth quarter, Arm reported revenues of $1.24 billion, reflecting a 34 percent increase year-over-year, and slightly exceeding market estimates. However, net income saw a decline of 6.7 percent, amounting to $210 million.

Rene Haas, Arm’s chief executive, noted that smartphone shipments have only increased modestly, yet royalties from this sector surged by 30 percent in the fiscal fourth quarter, attributed to the adoption of higher-end chips utilizing Arm’s latest technology, resulting in larger royalty payments. He remarked, “We’ve seen a significant gap between our royalties from smartphones and unit growth.”

Arm’s chip technology is integral to nearly every smartphone globally, and the company is also expanding into data centers, capitalizing on the rising demand for AI technologies.

Notably, Apple, one of Arm’s key customers, has projected an additional $900 million in costs this quarter as it shifts its supply chain strategies to mitigate trade war impacts.

According to research firm Counterpoint, changing trade policies are likely to weaken consumer demand, potentially leading to a contraction in the smartphone market this year.

Founded in 1990 as a collaboration between Acorn and Apple, Arm was acquired by SoftBank Group for £24 billion in 2016. The company debuted on the Nasdaq exchange in New York in September 2023 and currently boasts a market capitalization of approximately $131 billion, with SoftBank holding the largest share.

Post Comment